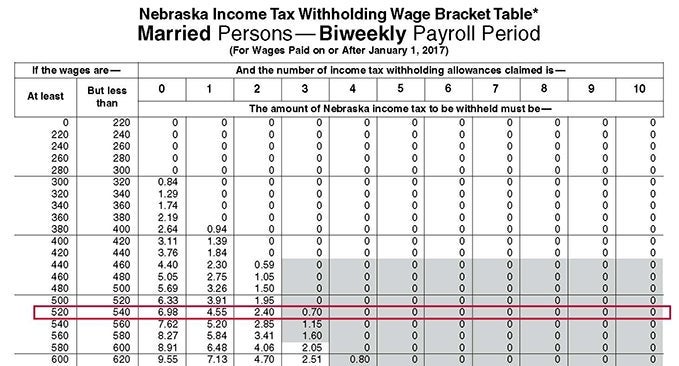

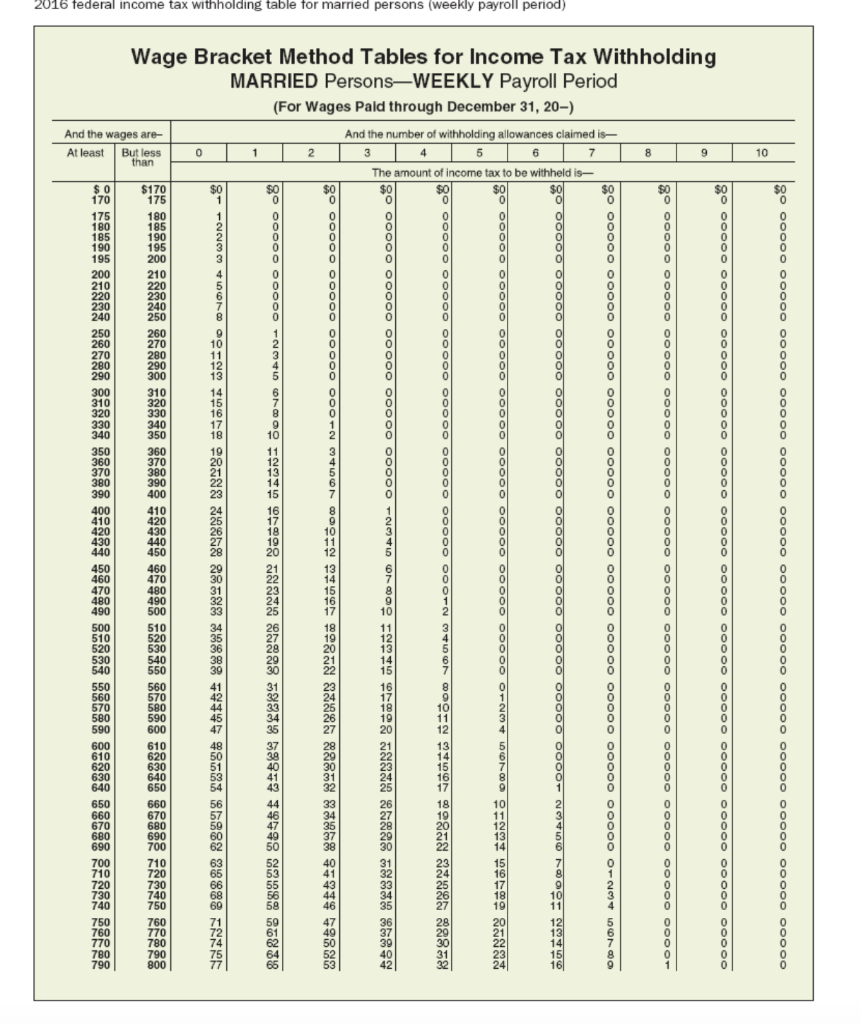

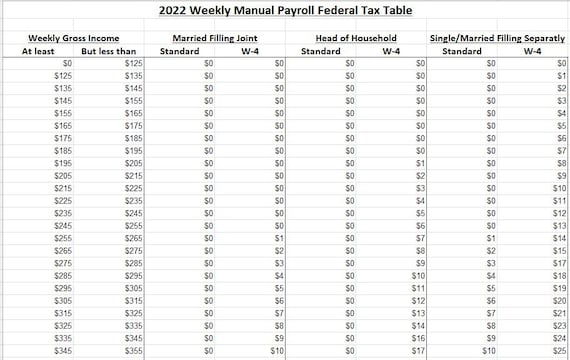

1 IOWA WITHHOLDING TAX -- BIWEEKLY TAX TABLE -- Effective January 1, 2022 If the Pay Period with Respect to an Employee is BIW

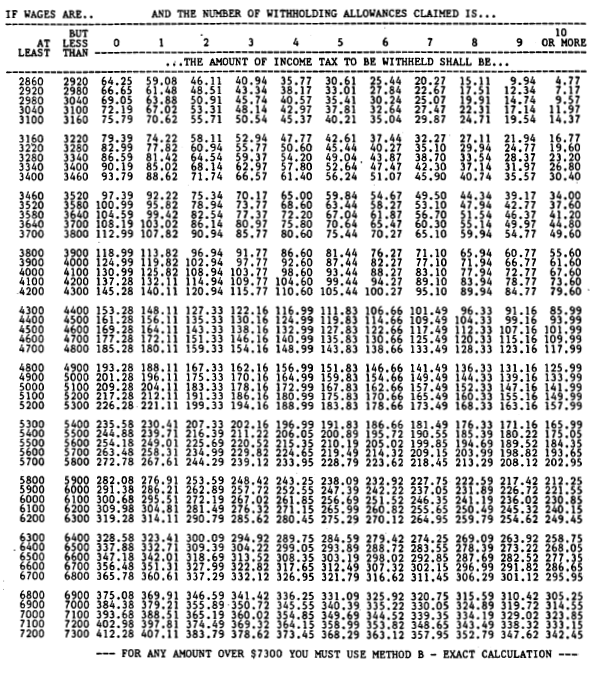

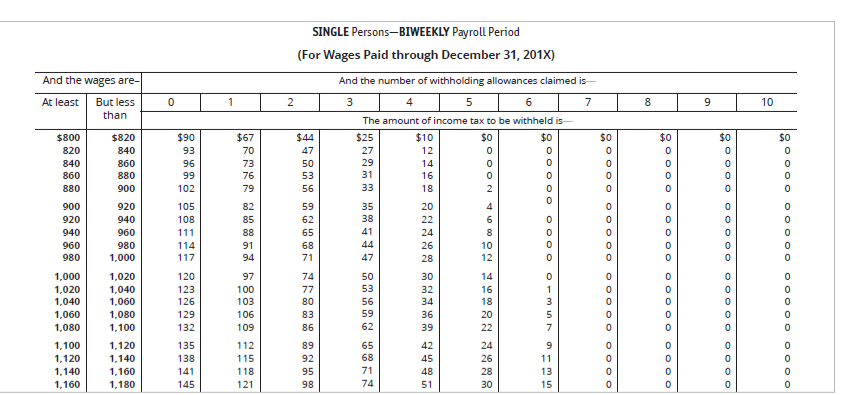

The following table shows the federal income tax for a single person for a biweekly payroll period - Brainly.com

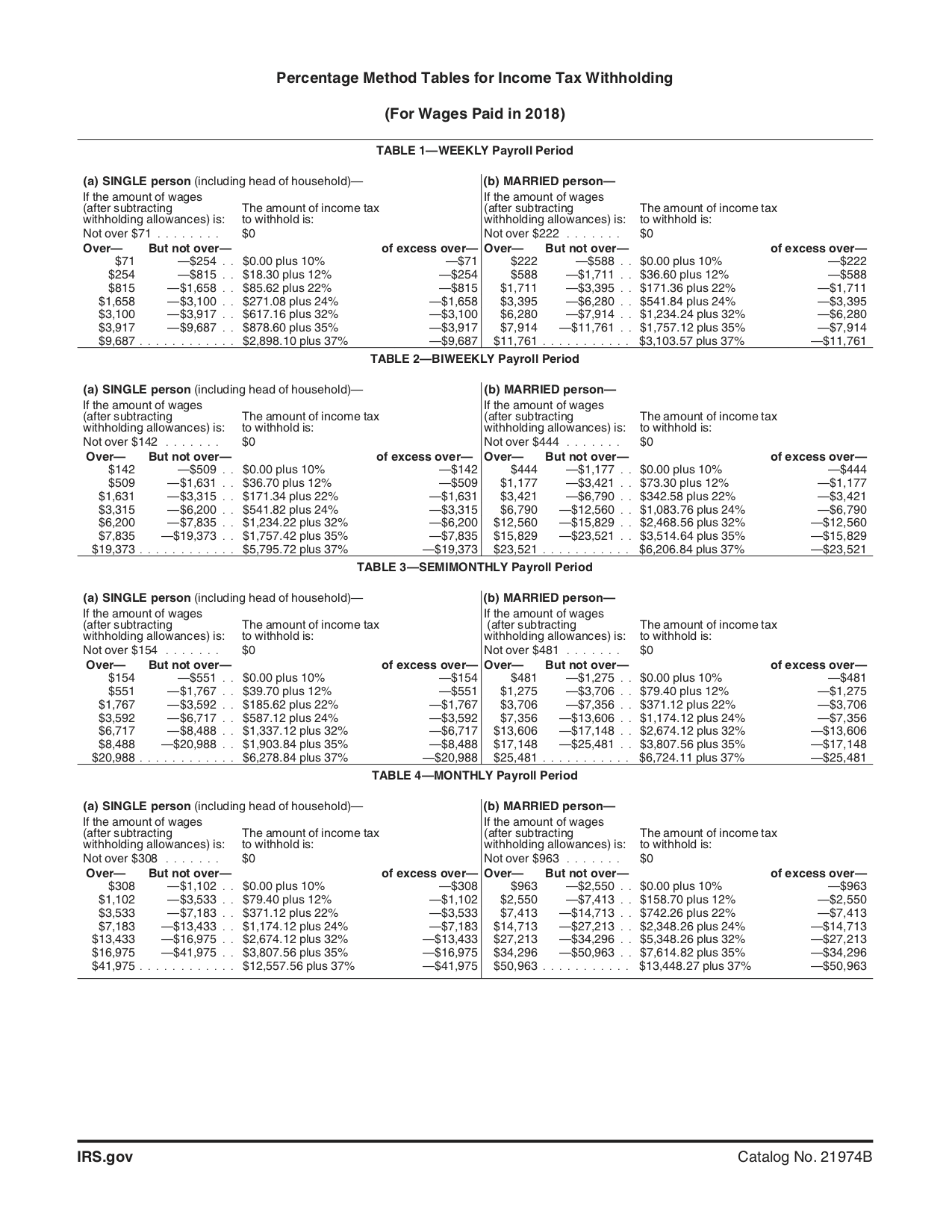

Publication 15, Circular E, Employer's Tax Guide; 16. How To Use the Income Tax Withholding and Advance Earned Income Credit (EIC) Payment Tables

Publication 15a: Employer's Supplemental Tax Guide; Combined Income Tax, Employee Social Security Tax, & Employee Medicare Tax Withholding Tables

Publication 15a: Employer's Supplemental Tax Guide; Combined Income Tax, Employee Social Security Tax, & Employee Medicare Tax Withholding Tables

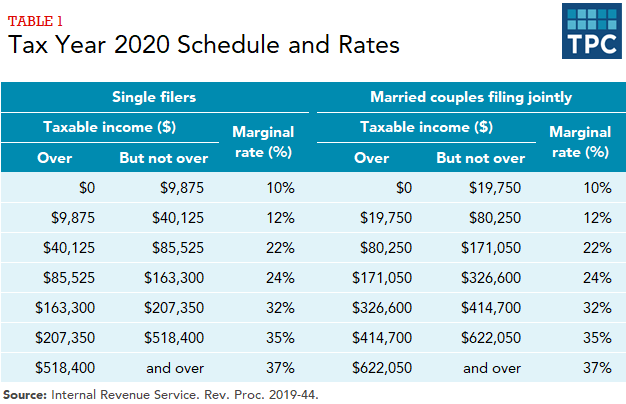

:max_bytes(150000):strip_icc()/w-4formmarriedfilingjointly-b61794485b5e44beab0ee2cfc3c9ae6e.png)

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)